How I Survived a Debt Crisis and Rebuilt My Financial Life

I used to lie awake at night, staring at the ceiling, overwhelmed by bills and panic. My debt felt like a storm I couldn’t escape. But over time, I learned not just how to survive a debt crisis—but how to use it as a foundation for smarter financial planning. This is the real, unfiltered story of what worked, what failed, and how I turned financial chaos into control—no magic tricks, just honest steps anyone can take. It wasn’t fast, it wasn’t easy, but it was possible. And if I could do it, so can you. This journey taught me that financial recovery isn’t about perfection; it’s about persistence, clarity, and the courage to face hard truths.

The Breaking Point: When Debt Becomes Unmanageable

There’s a moment, often quiet and unannounced, when debt stops being a background concern and becomes a daily crisis. For many, it arrives not with a single event, but with a slow accumulation of missed payments, late fees, and mounting anxiety. The phone calls from creditors grow more frequent. The mailbox becomes a source of dread. Sleep is disrupted not by noise, but by the weight of unpaid balances spinning in the mind. This is the breaking point—the moment when the illusion of control shatters, and reality sets in. It’s not always tied to a job loss or medical emergency, though those can accelerate it. Sometimes, it’s simply the result of years of living slightly beyond means, relying on credit to bridge gaps that never quite close.

What makes this phase so dangerous is how easily it can be ignored. People often respond to financial stress by avoiding bank statements, skipping bill due dates, or using one card to pay another. These are not signs of irresponsibility—they are survival instincts in a system that rarely teaches financial literacy. But avoidance only deepens the problem. Interest compounds. Fees pile up. Credit scores decline. The longer the situation is left unaddressed, the narrower the path to recovery becomes. The emotional toll is just as real as the financial one. Shame, isolation, and a sense of failure can make it harder to seek help, even when it’s available.

Recognizing this breaking point is the first step toward change. It’s not about assigning blame or reliving regret. It’s about acknowledging that the current path isn’t sustainable. That realization, painful as it may be, is also empowering. It creates space for action. It allows a person to shift from reaction to strategy. The key is to stop seeing debt as a moral failure and start seeing it as a solvable problem. Like any crisis, it can be overwhelming in the moment, but with structure, support, and clear steps, it can be managed. The goal isn’t to erase the past, but to build a different future—one decision at a time.

Facing Reality: Assessing Your Financial Picture Honestly

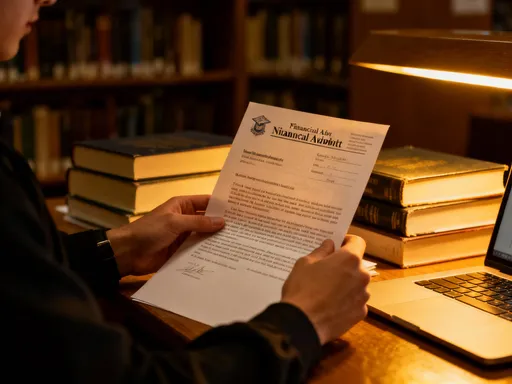

Once the decision to act has been made, the next step is one of the most difficult but essential: facing the full scope of the financial situation. This means gathering every bill, bank statement, credit report, and loan agreement and creating a complete picture of income, expenses, debts, and assets. No number should be hidden, no account forgotten. The purpose is not to induce guilt, but to achieve clarity. Without an accurate assessment, any recovery plan will be built on guesswork, and guesswork rarely leads to lasting results. This process can take several hours, even days, but it’s time well spent. It transforms a vague sense of overwhelm into a set of specific, addressable facts.

To begin, list all sources of income—wages, side jobs, child support, or any regular inflow. Be realistic about net income after taxes and deductions. Then, track all monthly expenses. This includes fixed costs like rent or mortgage, utilities, insurance, and transportation, as well as variable ones like groceries, clothing, and entertainment. Many people are surprised by how much they spend on small, recurring items—subscriptions, coffee runs, or delivery fees. These aren’t moral failings, but they do reveal where adjustments can be made. Next, compile every debt: credit cards, personal loans, medical bills, student loans, and any other obligations. For each, note the balance, interest rate, minimum payment, and creditor. This creates a debt inventory that serves as the foundation for a repayment strategy.

At the same time, take stock of assets—savings accounts, retirement funds, home equity, or valuable possessions that could be sold in an emergency. This isn’t about liquidating everything, but about understanding what resources are available. The goal is to see the full financial ecosystem, not just the debts. This holistic view helps identify leverage points—where extra payments can be made, where expenses can be reduced, and where help might be needed. It also reveals patterns. For example, high-interest credit card debt might be driven by unexpected medical costs or car repairs, suggesting the need for an emergency fund. Or, a low income relative to expenses might indicate the need for a side job or career change. The truth, once uncovered, becomes a roadmap.

Building a Shield: Prioritizing Emergency Savings (Even in Debt)

One of the most counterintuitive but powerful steps in financial recovery is starting to save—even while paying off debt. It may seem backwards to set aside money when creditors are demanding payment, but an emergency fund is not a luxury; it’s a protective barrier. Without it, any unexpected expense—a flat tire, a dental visit, a broken appliance—can force a person back into debt, undoing months of progress. The goal isn’t to build a large nest egg overnight, but to create a small but reliable buffer that prevents new borrowing when life throws a curveball.

Experts often recommend saving $500 to $1,000 as a starter emergency fund, even while making minimum debt payments. This amount won’t cover every possible crisis, but it can handle many common ones without resorting to credit. The key is consistency. Setting aside $20 or $50 a week may seem insignificant, but over time, it adds up. The money should be kept in a separate, easily accessible account—like a high-yield savings account or a dedicated bank account—to avoid temptation and ensure it’s available when needed. This account should be treated as untouchable except for true emergencies, not for shopping splurges or non-essential repairs.

The psychological benefit of this small fund is just as important as the financial one. Knowing there’s a cushion reduces anxiety and builds confidence. It shifts the mindset from constant crisis management to long-term planning. When an unexpected bill arrives, the reaction isn’t panic, but problem-solving. This sense of control reinforces positive financial behaviors and makes it easier to stick to a budget. Moreover, having even a modest emergency fund can improve creditworthiness over time, as it reduces the likelihood of missed payments. It’s a small investment with outsized returns. The message is clear: saving and debt repayment are not opposites. They are complementary strategies in the journey toward stability.

The Payoff Puzzle: Choosing the Right Debt Repayment Strategy

With a clear financial picture and a small emergency fund in place, the next step is to choose a debt repayment strategy. Two methods have stood the test of time and real-world use: the debt avalanche and the debt snowball. Both are effective, but they work in different ways and suit different personalities. The avalanche method focuses on saving money by targeting the debt with the highest interest rate first. This approach minimizes the total interest paid over time, making it the most mathematically efficient. For example, if one credit card charges 24% interest and another charges 15%, the avalanche method would prioritize paying off the 24% card first, even if the balance is larger. This reduces the cost of debt fastest.

The snowball method, on the other hand, prioritizes motivation over math. It involves paying off the smallest balance first, regardless of interest rate. Once that debt is cleared, the payment amount is rolled into the next smallest debt, creating a growing momentum—like a snowball rolling downhill. While this method may result in slightly more interest paid overall, it delivers quick wins that can boost morale and commitment. For many people, seeing a debt completely disappear, even if it’s small, provides a psychological lift that keeps them engaged in the process. The sense of progress becomes its own reward.

Choosing between these methods depends on individual temperament. Someone who is analytical and focused on long-term savings may prefer the avalanche. Someone who needs visible progress to stay motivated may find the snowball more effective. There is no single right answer. What matters is consistency and follow-through. Whichever method is chosen, it should be applied systematically. Minimum payments must continue on all other debts to avoid penalties, while extra funds are directed to the priority debt. As each debt is paid off, the freed-up money increases the payment on the next one, accelerating the process. The key is to stick with the plan, even when progress feels slow. Over time, the results compound, just like interest—but in the user’s favor.

Negotiating Your Way Out: Talking to Creditors Without Fear

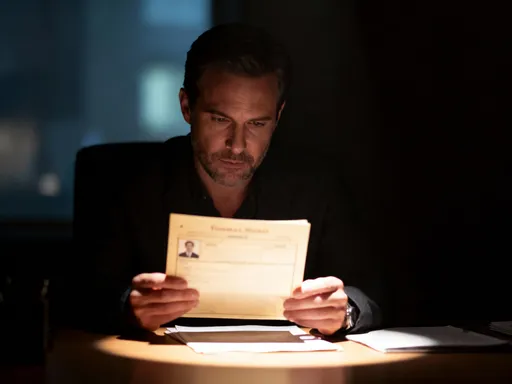

One of the most underused tools in debt recovery is negotiation. Many people assume they must accept the terms set by creditors, but that’s not true. Most lenders are willing to work with borrowers who are proactive and honest about their situation. The goal of negotiation is not to erase debt, but to make it more manageable—through lower interest rates, reduced payments, or extended timelines. The first step is to contact the creditor directly, preferably by phone, and explain the hardship clearly and calmly. It’s important to be specific: instead of saying “I can’t pay,” say “I’ve lost income due to a job change and can only afford $X per month right now.”

Creditors are more likely to help if they believe the borrower intends to pay and is taking responsibility. They would rather receive a reduced amount consistently than risk a default. Common options include hardship programs, which may offer temporary relief such as suspended payments or lower interest for a set period. Some may agree to a debt settlement, where a lump sum less than the full balance is accepted as payment in full. This can damage credit in the short term but may be preferable to prolonged delinquency. Whatever the outcome, any agreement must be confirmed in writing before making a payment. Verbal promises are not binding.

Preparation is key. Before calling, gather all relevant information: account numbers, current balances, income details, and a proposed payment plan. Practice what to say to stay calm and focused. It’s normal to feel anxious, but remember that creditors are businesses, not personal enemies. Their goal is to get paid, not to punish. By approaching the conversation with respect and clarity, many people find that lenders are more flexible than expected. This process doesn’t guarantee success in every case, but it transforms a feeling of helplessness into agency. It’s a reminder that financial recovery is not a solo journey—there are systems and people designed to help, if asked.

Preventing Relapse: Designing a Realistic Budget That Sticks

Escaping debt is a major achievement, but the real challenge is staying out of it. Many people fall back into old patterns not because they lack willpower, but because their budget doesn’t reflect real life. A budget that’s too strict or unrealistic will fail, often leading to guilt and abandonment. The solution is not perfection, but adaptability. A realistic budget accounts for both necessities and occasional treats. It includes room for surprises and adjusts as income or expenses change. The goal is sustainability, not austerity.

One effective approach is the 50/30/20 framework, which divides after-tax income into needs (50%), wants (30%), and savings or debt repayment (20%). This is not a rigid rule, but a guideline that encourages balance. Needs include rent, groceries, utilities, and minimum debt payments. Wants cover dining out, hobbies, and entertainment. Savings include emergency funds, retirement, and extra debt payments. By allocating specific percentages, the budget becomes a tool for intentionality rather than restriction. It allows for enjoyment while ensuring progress toward financial goals.

Tracking is essential. Whether using a notebook, spreadsheet, or budgeting app, regular monitoring helps identify trends and catch overspending early. Weekly check-ins are more effective than monthly ones, as they allow for timely corrections. It’s also helpful to set up alerts for bill due dates and low balances to avoid fees. Over time, budgeting becomes less about counting every dollar and more about building awareness. It’s not about denying oneself, but about making conscious choices. When a purchase is made, it’s not an impulse, but a decision aligned with values and goals. This shift in mindset is what turns a budget from a temporary fix into a lifelong habit.

From Crisis to Control: Turning Pain into Long-Term Financial Strength

The journey out of debt is rarely linear. There are setbacks, doubts, and moments of exhaustion. But each step forward builds resilience. What begins as a crisis can, over time, become a foundation for lasting financial strength. The lessons learned—honesty, discipline, adaptability—are not limited to debt repayment. They extend to every area of money management. A person who has rebuilt their finances is better equipped to handle future challenges, whether it’s saving for a home, planning for retirement, or supporting a family.

This transformation doesn’t require wealth or privilege. It requires only the willingness to start, to keep going, and to learn from mistakes. The debt crisis, painful as it was, becomes a turning point—a moment of clarity that reshapes priorities. It teaches that financial health is not about never making mistakes, but about knowing how to recover. It fosters a deeper relationship with money, one based on respect rather than fear. And it proves that change is possible, even when the odds seem stacked.

Over time, the focus shifts from survival to growth. Credit can be rebuilt by making on-time payments and keeping balances low. Savings can grow into investments that generate long-term security. The habits formed during recovery—budgeting, tracking, planning—become second nature. The person who once felt trapped by debt now feels in control. The storm has passed. The ground is firm. And from this new foundation, a more stable, confident financial life can be built—one honest step at a time.