When to Upgrade Your Appliances? Smart Moves That Save You Cash

Thinking about replacing that old fridge or worn-out washing machine? Timing your appliance upgrade right can mean the difference between a smart financial move and a money pit. I’ve been there—rushing into a purchase, only to regret it later. In this article, I’ll walk you through the real deal: when to pull the trigger, what signs to watch for, and how to avoid overspending. These insights could save you hundreds—maybe even thousands—over time. This isn’t about chasing the latest gadgets or giving in to flashy sales. It’s about making deliberate, informed decisions that align with your household’s actual needs and long-term budget. Let’s explore how upgrading appliances can be more than just a chore—it can be a strategic financial choice.

The Hidden Cost of Waiting Too Long

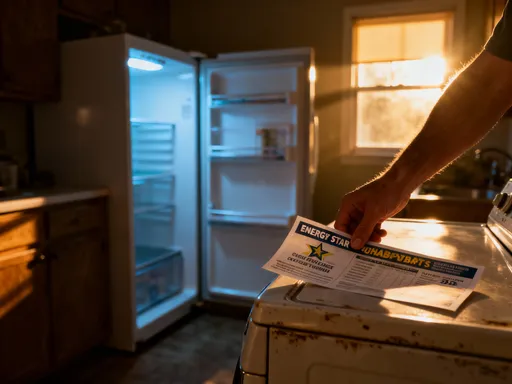

Many homeowners delay appliance upgrades until something breaks completely, believing they are being frugal by extending the life of their current devices. While this approach may seem economical at first glance, it often leads to higher costs over time. Appliances lose efficiency as they age, and this gradual decline can quietly inflate monthly utility bills. For example, a refrigerator manufactured before 2010 typically uses significantly more electricity than newer models. According to the U.S. Department of Energy, older refrigerators can consume nearly twice the energy of modern ENERGY STAR-certified units. This means that even if your fridge still cools food, it may be working much harder—and costing you more—to do so.

The financial burden of outdated appliances isn’t limited to electricity. Washing machines from the early 2000s, for instance, use more water and require longer cycles than today’s high-efficiency models. Over the course of a year, a household doing five loads per week could use thousands of extra gallons of water, translating into noticeably higher water and sewer bills. Similarly, older dishwashers often lack the precision cleaning and low-water usage of newer versions, leading to repeated cycles and wasted resources. These inefficiencies accumulate over time, turning what feels like a money-saving delay into a slow drain on household finances.

Another hidden cost lies in repair frequency. As appliances age, their components wear out, leading to more frequent breakdowns. Each repair visit comes with labor charges, part replacements, and downtime. While a single repair might cost $100 to $200, multiple fixes over a year can easily exceed $500—sometimes approaching the price of a new, more efficient unit. Worse, repairs on aging appliances are often temporary fixes that don’t address underlying wear. Homeowners may find themselves in a cycle of recurring issues, paying more in cumulative repairs than they would have spent on a timely replacement.

Additionally, older appliances are more likely to fail at inconvenient times, creating stress and urgency that can lead to rushed purchasing decisions. Emergency replacements often mean buying whatever is available, without the opportunity to research options or wait for sales. This lack of control typically results in higher prices and less optimal choices. By waiting until failure, families not only miss out on energy savings but also sacrifice the ability to plan financially. The reality is clear: delaying an upgrade in the name of saving money can ultimately cost more in both dollars and peace of mind.

The Sweet Spot: When Upgrades Make Financial Sense

There is a strategic window during an appliance’s lifespan when replacement becomes not just reasonable, but financially advantageous. This sweet spot typically occurs when a major appliance is between 8 and 12 years old and begins to show signs of declining performance. At this stage, the device is likely past its peak efficiency but not yet in constant need of repair. Recognizing this phase allows homeowners to transition from reactive fixes to proactive planning, turning what could be an emergency expense into a calculated investment.

One of the clearest indicators that an appliance has entered this upgrade zone is inconsistent performance. A refrigerator that struggles to maintain a steady temperature, especially in the refrigerator compartment, may be working harder than necessary. Similarly, a dishwasher that leaves spots on glassware or requires pre-rinsing despite proper loading may no longer be operating at full capacity. Washing machines that vibrate excessively, take longer to complete cycles, or fail to clean clothes effectively are also signaling inefficiency. These issues may not render the appliance unusable, but they do suggest rising energy and water consumption, as well as increased wear on internal components.

Average lifespan data supports this timing. Refrigerators typically last 10 to 14 years, dishwashers 9 to 13 years, and washing machines 10 to 12 years under normal use. Beyond these ranges, failure rates rise significantly. However, waiting until the 13th or 14th year means operating in a high-risk zone where breakdowns are more likely. Upgrading at the 10-year mark—especially if performance has dipped—can prevent unexpected failures while still capturing the majority of the appliance’s usable life. This approach balances longevity with reliability and cost-efficiency.

Another factor to consider is the pace of technological improvement. Appliance efficiency has advanced considerably over the past decade. A washing machine from 2010, while once considered efficient, now falls short of current standards. Modern units use 30% to 50% less water and energy, depending on the model and usage. By upgrading within the 8–12 year window, homeowners can take advantage of these improvements before their old appliances become energy hogs. This timing also allows for budgeting and research, ensuring that the new purchase aligns with household needs and financial goals. The goal is not to replace appliances prematurely, but to act before inefficiency and risk outweigh the benefits of continued use.

Energy Efficiency: The Long-Term Payoff

One of the most compelling reasons to upgrade appliances is the dramatic improvement in energy efficiency over the past decade. Modern refrigerators, washing machines, and dishwashers are engineered to deliver the same or better performance while using significantly less electricity and water. ENERGY STAR-certified models, which meet strict efficiency guidelines set by the U.S. Environmental Protection Agency, are particularly effective at reducing household utility consumption. For homeowners, this translates into direct savings on monthly bills—a benefit that compounds over time.

Consider a typical household upgrading from a 2010 refrigerator to a current ENERGY STAR model. The older unit may consume around 700 kilowatt-hours (kWh) per year, while a new efficient model uses closer to 400 kWh annually. At an average electricity rate of $0.15 per kWh, that difference amounts to about $45 in annual savings. Over a 10-year period, that adds up to $450—money that stays in the household budget rather than going to the utility company. While the upfront cost of a new refrigerator may range from $800 to $1,500, the ongoing savings help offset the initial investment, effectively shortening the payback period.

Washing machines offer even greater potential for savings. Top-loading models from the early 2010s used about 40 gallons of water per load, while modern high-efficiency front-loaders use as little as 15 gallons. For a family doing five loads per week, this reduction can save more than 4,000 gallons of water annually. When combined with lower energy use for heating water, the total utility savings can exceed $100 per year. Dishwashers have seen similar improvements, with newer models using as little as 3 gallons per cycle compared to 6 or more in older units. These reductions not only lower bills but also lessen environmental impact, making efficiency upgrades a win-win for both wallet and planet.

The pace of innovation in appliance efficiency has accelerated in recent years, making now a particularly favorable time to upgrade. Manufacturers have refined insulation, compressors, motors, and control systems to maximize performance with minimal resource use. In many cases, the efficiency gains between a 10-year-old model and a current one are greater than those seen in the previous 10 years combined. This means that waiting longer to upgrade may mean missing out on some of the most significant savings opportunities. By acting now, homeowners can lock in lower operating costs for the next decade, turning an appliance purchase into a long-term financial strategy.

Seasonal Sales and Retail Cycles: Timing Your Purchase

When you buy an appliance can be just as important as which one you buy. Retailers follow predictable cycles that create regular opportunities for savings, and savvy shoppers who time their purchases accordingly can save hundreds of dollars without compromising on quality. Understanding these patterns allows homeowners to align their upgrade plans with market trends, turning a necessary expense into a smart financial move.

One of the best times to shop for appliances is during major holiday weekends, such as Memorial Day, Labor Day, and the Fourth of July. These periods are traditionally marked by deep discounts on large home goods, including refrigerators, washers, and dryers. Retailers use these holidays to clear out inventory and make room for new models, offering promotions that can include bundled deals, price reductions, or free delivery. For example, a $1,200 refrigerator might be available for $999 during a holiday sale, representing an immediate savings of over 15%. These events are widely advertised, making them accessible to most consumers.

Another prime window is during the spring and fall, when manufacturers typically release updated appliance lines. As new models arrive in stores, retailers discount outgoing versions to free up floor space and warehouse capacity. This end-of-cycle clearance can result in substantial markdowns, often without any reduction in quality. A refrigerator discontinued to make way for a newer version may be just as reliable and efficient as its successor but priced significantly lower. Shoppers who are flexible and willing to consider last year’s model can take advantage of these deals while still getting a modern, efficient appliance.

Additionally, some retailers offer special promotions at the end of the calendar year or fiscal quarter to meet sales targets. These events may not be as heavily marketed as holiday sales but can still yield meaningful discounts. By monitoring store websites, signing up for newsletters, or speaking with sales representatives, homeowners can stay informed about upcoming promotions. The key is to avoid buying out of urgency and instead wait for these cyclical opportunities. With a little patience and planning, a necessary appliance upgrade can become a financially strategic purchase.

Incentives and Rebates: Free Money You Might Be Missing

Many homeowners overlook a powerful tool that can reduce the cost of appliance upgrades: rebates and incentives. Federal, state, and local programs, as well as utility companies and manufacturers, frequently offer financial incentives for purchasing energy-efficient appliances. These programs are designed to encourage energy conservation and reduce overall demand on the power grid. For consumers, they represent a direct reduction in the net cost of a new appliance—essentially free money that should not be left on the table.

Federal tax credits are one of the most valuable incentives available. While not all appliances qualify, certain high-efficiency models—particularly electric heat pump water heaters and HVAC systems—may be eligible for credits that reduce income tax liability. These credits can range from a few hundred dollars to over $1,000, depending on the appliance and program year. Though refrigerators and washing machines are not currently covered under federal tax credits, other efficiency-related home improvements may be, and bundling upgrades can maximize benefits.

Utility company rebates are more commonly available for standard appliances. Many electric and water providers offer instant discounts or mail-in rebates for customers who replace old units with ENERGY STAR-certified models. For example, a utility might offer a $75 rebate for a new clothes washer or a $50 incentive for an efficient dishwasher. These programs vary by region, so it’s essential to check with your local provider. Some utilities even have online portals where customers can search for eligible appliances and apply for rebates before making a purchase.

Manufacturers also run promotional rebates, especially during model transitions or holiday sales. These can be combined with retailer discounts and utility incentives to create layered savings. A shopper might find a $200 manufacturer rebate on a new refrigerator, stack it with a $150 utility incentive, and apply a $100 holiday discount—resulting in $450 off the original price. The process requires some research and paperwork, but the payoff is substantial. By taking the time to explore all available programs, homeowners can significantly reduce the financial burden of an upgrade and improve the return on their investment.

Avoiding the Upgrade Trap: When Not to Buy

Just because an appliance can be upgraded doesn’t mean it should be. The market is filled with attractive features, sleek designs, and persuasive marketing that can tempt even the most budget-conscious shopper. However, not every upgrade delivers real value. Emotional spending, unnecessary smart technology, and oversized units can lead to overspending without improving daily life. Recognizing when *not* to buy is just as important as knowing when to upgrade.

One common pitfall is the allure of smart features. Many new appliances come equipped with Wi-Fi connectivity, app controls, and voice command compatibility. While these functions may seem futuristic, most households rarely use them after the initial novelty wears off. A smart refrigerator with a touchscreen and grocery list app may cost $300 more than a standard model, but if those features go unused, the extra expense is pure waste. Similarly, a washing machine that sends cycle notifications to your phone offers little practical benefit for most families. It’s wise to evaluate which features genuinely enhance convenience and which are merely marketing gimmicks.

Another trap is choosing appliances that are too large for actual needs. A 30-cubic-foot refrigerator may sound impressive, but if a household doesn’t cook in bulk or store large quantities of food, much of that space goes unused. Larger units consume more energy, cost more to cool, and take up valuable kitchen space. The same principle applies to washers and dryers—oversized drums don’t improve cleaning and can lead to wasted water and electricity. Selecting a model that matches real usage patterns ensures efficiency and value.

Sales pressure is another factor to watch for. In-store promotions, limited-time offers, and financing deals with “zero percent interest” can create a false sense of urgency. While some offers are legitimate, others are designed to encourage impulsive decisions. Financing, in particular, can be risky if payments extend beyond the appliance’s useful life or if interest kicks in after a grace period. The best approach is to stick to a pre-determined budget, focus on essential features, and walk away if the deal doesn’t align with actual needs. Discipline in the buying process prevents regret later.

Building a Long-Term Appliance Strategy

Treating appliance upgrades as isolated events leads to reactive spending and financial stress. A better approach is to integrate these purchases into a long-term household financial strategy. By planning ahead, tracking appliance ages, and setting aside funds gradually, families can avoid surprises and make smarter decisions. This proactive mindset transforms appliance maintenance from a series of emergencies into a manageable, predictable part of home management.

A simple first step is to create a household appliance inventory. List each major device, its purchase date, and expected lifespan. Update this record annually and use it to anticipate future replacements. For example, if a dishwasher is approaching 10 years of age, begin researching options and saving funds a year or two in advance. This preparation allows time to compare models, monitor sales cycles, and apply for rebates—maximizing value and minimizing stress.

Another effective tactic is to establish a dedicated savings fund for appliance replacements. Setting aside $50 to $100 per month in a separate account can accumulate $600 to $1,200 annually—enough to cover a significant portion of a new appliance’s cost. This method smooths out large expenses over time, preventing the need for credit or emergency spending. It also fosters financial discipline, reinforcing the idea that appliances are long-term investments rather than impulse buys.

Prioritization is also key. Not all appliances need replacement at once. Focus first on units that are oldest, least efficient, or most frequently used. A failing refrigerator or a leaky washing machine should take precedence over a slightly outdated microwave. By ranking upgrades based on impact and urgency, households can allocate resources where they matter most. Over time, this systematic approach leads to a more efficient, reliable, and cost-effective home. Ultimately, smart appliance management isn’t about perfection—it’s about progress, planning, and peace of mind.